Dear Partners,

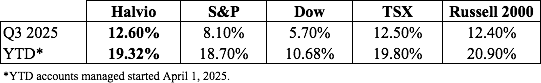

Accounts managed by Halvio Capital returned 12.6% in Q3 2025 compared to the Dow Jones 5.7%, S&P 500 8.10%, Russell 2000 12.4% and TSX 12.5%. Since managing accounts starting April 1, 2025 Halvio has returned 19.32%, which is roughly in the middle of the main indices.

Just a reminder that while we are off to a very solid start in the first 6 months on an absolute basis, on a relative basis the market has kept pace so far. But it’s both the relative AND absolute outperformance I am seeking and when taking a 3 to 5 year view I believe we’ll get there. The strong performance came from Cipher, a new position in EDU Holdings but also pretty much everything we owned was either up or flat during the quarter. It’s just that type of market right now and I don’t expect that to happen each quarter if ever.

While some of our larger positions haven’t really changed, the smaller parts of the portfolio have turned over a bit as I comb through more and more stocks. Comparing what we own to what I think is a better opportunity for our capital. I obviously would prefer less turnover but it is a cost of finding, what I think, are better opportunities. In a raging bull market, it’s been tough to keep shiny object syndrome and FOMO at bay and while every investor would like to stick to the adage of “buy and hold”, I have no problem selling something if I see something I like better. Having said that, it can come back and bite me as one of our holdings, Daktronics, was sold during the quarter, only for it to rally nearly 50% a few weeks after we sold. While I’ll never be able to time the bottom or top of a stock, these things will happen from time to time.

In a market that only goes up, I’m still seeing a lot of value in the smaller areas of the market where larger funds can’t purchase companies that fit my investment style. Some of these companies might not even have volume for days but as long as there is some type of value there I’ll be interested.

Positions Sold

During the quarter we sold Currency Exchange International (OTCPK:CURN), Medical Facilities Corp. (OTCPK:MFCSF), Daktronics (DAKT) and a few positions in the Japanese basket. While I do think all of these will do well, I just found other companies I like better at this point in time.

Top 5 Holdings

The top 5 positions in our accounts in no particular order are a basket of Japanese companies, FILA SpA, Cipher Pharmaceuticals (OTCQX:CPHRF), Net Lease Office Properties (NLOP) and Mestek Inc (OTCPK:MCCK).

Japan Basket

The Nikkei index reached all-time highs so far this year of 45,000 after taking 35 years (1989 to 2024) to reach its prior peak. Clearly the Japan Inc. corporate reforms have been working as there have been a record amount of share buybacks, takeover offers by foreign firms, activist campaigns and MBOs so far in 2025. The Japan Exchange Group CEO this summer said that the reforms are about 20% of the way there, which I agree with as there are still plenty of smaller listed companies not partaking in returning what is clearly excess capital to shareholders.

The large turnover I mentioned above occurred a lot in the Japan basket as I sold Kawaii, Keihin, Gamecard and some other smaller positions and have allocated to a couple new ideas detailed below at the end of this letter. Keihin was sold because I never heard back from them and figured a company that is aiming to hit a P/B of 1x in 5 years when they can just pay a dividend or buy back shares today isn’t serious still about their stock price. The other ones I sold because I think I found better opportunities for the capital where there are actual catalysts or current shareholder return policies being implemented today. Right now each Japan stock we own has repurchased shares in the past 12 months, some more than others.

F.I.L.A. SpA (FILA.MI)

FILA declined during the quarter as a result of an analyst downgrade amidst an uncertain US outlook. Sales and EBITDA also declined slightly in the 1H 2025 compared to 1H 2024 due to a difficult market environment with tariffs and reduced government funding in the US for schools. However, FILA reconfirmed their free cash flow guidance of between €40 – €50 million and EBITDA will most likely come in around €100 million. Some of that free cash is being returned to shareholders this year in dividends. DOMS, who FILA currently owns a 26% stake in, displayed strong Q1 revenue, EBITDA and profit growth YoY at 26.3%, 14.3% and 8.8% respectively. The stock has increased a bit as a result of India announcing GST cuts due to the 50% tariffs the US has placed on India. DOMS products (writing instruments, stationery) GST tax rate will go from 12% down to 0% which could provide an increase in domestic demand. DOMS is held at €140 million on FILA’s balance sheet but the market value today is €397 million. This would put FILA at less than 3x EBITDA and if you haircut DOMS by 50%, FILA is at roughly 5x EBITDA. I see very little downside at these levels. Some push back I’ve gotten about this idea is 1) Will FILA sell down DOMS anymore and 2) They look overlevered.

My response to #1 is that with many companies that have some type of valuable asset or subsidiary inside their overall corporate structure, investors always push management to spin these assets off to highlight the underlying value and get a mark. Not only has FILA done just that, but they’ve also monetized half of their stake since doing so. The market only seems to want to value FILA’s stake in DOMS if it is converted into cash, but by that time the stock will have reacted and it’ll be too late. FILA’s management has stated recently that they have no plans in the next 12 months to sell any more DOMS unless they see a good opportunity to buy another asset, which in this market environment could happen. As a large shareholder of a company, you don’t telegraph to the market you’re going to be selling and have the stock tank in anticipation of the sale and create an overhang. While I don’t know if they will sell down further, I’m perfectly content with them continuing to own this dominant, growing asset that they could sell tomorrow if they wished.

With regards to #2, while it might look like they are overlevered, their net debt/EBITDA is just 2x, hardly overlevered in my opinion and just above their target 1.0 – 1.5x. This also doesn’t take into account their €397 million investment in DOMS which would turn their net debt into net cash depending on how you want to value DOMS. FILA is also a seasonal business and the calculation of their net debt is going to be affected by which quarter you are computing it. If you look at FILA’s quarterly balance sheets going back the last 10 years, their lowest cash balances are usually in the first 9 months followed by a significant increase in the December 31 balance sheet as a result of collections happening in Q4. While they’ve done an excellent job paying down debt over time, computing net debt or enterprise value using just one balance sheet can be misleading and should most likely be averaged for the year.

Cipher Pharmaceuticals Inc. (CPH.TO)

I increased our Cipher position during the quarter as I felt the market was undervaluing the potential earnings power of the company combined with a smart capital allocator at the helm. So far it was the right call as Cipher reported extremely good results for Q2 and the stock reacted favourably. Cipher earned the most revenue in a quarter in their history of $13.4m and $7.6m in EBITDA. Their Q3 should be even better as their Natroba product generates more revenues in the warmer months as it is a bit seasonal. They paid down $15m of the debt from their last year’s acquisition with another $7m after the quarter which would bring their total debt now to $18m. This is a company that had $40m in debt this time last year, which shows the cash flows the company is able to produce today. At the same time they’ve been buying back stock in the market as well. $2m during the second quarter and by my calculation just under $3m so far in Q3.

This summer the CEO did an interview and confirmed that the company generates over US$2m in cash flow a month which means they will be in a net cash position again soon by potentially the end of the year. They are extremely focused on making another product or business acquisition that would strengthen their US business and will have the balance sheet to do so with access to a $65m revolver as well. Their goal is to be a larger, more US focused business and then uplist to the NASDAQ down the road.

Net Lease Office Properties (NLOP)

NLOP is our office REIT that is in wind down mode. During the quarter they paid their first, and hopefully many more, special dividend of $3.10/share totalling $46m. They also sold a property for $25m and currently have a few listed including the famous Binoculars Building in Venice.

There was a buyout of an office REIT in July, City Office REIT, for $1.1 billion. While their office buildings are in better located, larger cities with favourable demographics (employment, population growth) and a diverse tenant base, if you apply 2/3s of the $204 price per/sq.ft that they received to NLOP’s square footage without the encumbered properties, it’s a $43 stock today. I still think it’s worth a bit more than that but using that conservative number still gets you to a stock price higher than today’s.

And the special dividends that will be coming will increase the IRR of the investment. By my numbers the buyout was also done at a 7% cap rate vs NLOP’s current high teens cap rate.

Looking at the balance sheet can still cause some investors confusion as it looks like they have $117m of debt on the books. But this debt is for 6 properties out of 35 that they can hand back the keys to and wipe the debt out. They also took an $82m impairment charge on their largest property which could be giving investors a little bit of hesitation. The reason given in the 10-Q was they changed their discount rates.

Definitely something to keep an eye on but this property still has 5 years’ worth of $20m contractual rent owing and it remains to be seen what they ultimately can get for it.

Mestek Inc. (OTCPK:MCCK)

Mestek Inc. (OTCPK:MCCK) is a new position and is, in the CEO’s own words, “an oddball investment”. It’s a $347m market cap OTC company that’s been around since the 1940’s and owns over 45 specialty manufacturers of HVAC and metal forming equipment businesses that they’ve purchased over the past 60-70 years with their most recent acquisition in 2021. They manufacture mature products like louvers, baseboard heaters, HVAC fan coils, fire dampers, etc. Their HVAC segment makes up over 80% of their sales and they principally sell into North America. Last year they did $400m in revenue and $34m in operating earnings. Although they are tied to the cyclical construction industry (industrial, commercial, office), their operating earnings the past 10 years have been relatively stable and they didn’t even suffer a loss during COVID.

What makes this an “oddball investment” is that the CEO, who owns 75%, has taken the cash flows from the business and started trading commodities like platinum futures. This has created some noise in the financials but by my calculations, he’s generated about $189m in pre-tax commodity income the past decade. With platinum up 50% YTD, this year’s commodity gains are $62m so far. While not ideal to have a commodity hedge fund inside a stable manufacturing business, there is now a vast cash balance that makes up for a majority of the enterprise value. With a $347m market cap, cash/ST investments and the commodity portfolio total $327m which offers substantial downside protection. With other liability adjustments, the total enterprise value is $90m right now. This would put the trailing EV/EBIT at 2.6x and the company has already done $21m in EBIT in the first 6 months of 2025. Larger comparable companies that touch the HVAC space trade at high teens EV/EBIT multiples and small niche manufacturers trade at a minimum of high single digit EV/EBITDA.

A recent transaction that caught my eye was Worthington Enterprises $93m purchase of Elgen Manufacturing, a smaller privately-owned New Jersey HVAC manufacturer of parts and components for 7x EV/EBITDA. Applying that same multiple to Mestek’s 2025 estimated EBITDA results in an $85 stock price which is about 85% upside. Mestek also reports their inventory using LIFO which underreports their inventory and over-reports COGS. Adjusting for this would add a few dollars more per share to the value as well.

The CEO has said that he would much rather acquire some more businesses than pay dividends so while a special dividend would definitely be welcomed, I take some comfort from the extremely cheap entry multiple provided the commodity portfolio doesn’t blow up. Even if you disregard the commodities on the balance sheet, there is still a little upside by estimates.

Smaller Positions

Citizens Bancshares Corp. (OTCPK:CZBS) earned over $7 of EPS when adjusting for the amount paid on their preferred dividends in 2024 putting them at 7x adjusted trailing earnings. They continue to trade at a substantial discount to their adjusted BVPS of $85/share vs a stock price of $47 and just announced a share buyback for $4 million. Tetragon Financial Group (TFG.AS)(OTC:TGONF) has hit all-time highs as the market has 1) become more aware of their Ripple stake and 2) Ripple keeps buying back their own shares at increasing prices. Leons Furniture (LNF.TO) announced an excellent Q2 as sales, margins and profits were up YoY and they raised their dividend by 20%. No timeline was mentioned still regarding their intention to IPO the underlying real estate. EDU Holdings Limited (EDU.AX)(OTCPK:EDUH.F) insiders dropped their attempted MBO quickly in May and the stock has increased significantly as results YTD have shown significant revenue and earnings inflection. While the stock has run up, it still trades at 4x next year earnings without taking any growth into account in addition to a strong net cash balance sheet. Western Capital Resources Inc. (WRCS) trades slightly below the April tender offer price of $15/share. They continue to buy arenas with favourable financing terms and trade for 3x – 4x normalized EV/EBIT and right around book value.

Market Outlook

The market felt slightly frothy at the beginning of July and it seems like it’s gotten even more so. I continue to have no idea if the next move will be up or down in the short term and have no intention of making a prediction. Companies are still seeing their stocks rocket by raising money to purchase bitcoin, ethereum and even tokens of an eyeball scanning company. AI is still the highlight of the market and a pretty stunning stat I read the other day said that since ChatGPT was launched in late 2022, AI related stocks have accounted for 75% of the returns for the S&P 500 and 80% of the S&P earnings growth.

No industry is currently safe from US tariffs. The pharma industry just got hit with 100% tariffs if you don’t manufacture your product in the US, foreign film production outside the US got hit with 100% and even imported kitchen cabinets were just targeted at 50%. So with the added uncertainty the US administration is giving the business industry with the potential to upend industry supply chains and consumer demand, the government is also taking stakes in certain companies tied to strategic industries like semiconductors and rare earths and plans to make similar investments going forward. While each investment has produced significant gains for the US taxpayer due to their ownership, the lines of capitalism and quasi-nationalism seem to be starting to cross. Not to mention the golden share afforded to the government in the recent merger between US and Nippon Steel which allows the US government certain corporate decision making powers like the ability to force the company to not close manufacturing plants. It’s an extremely uncertain time but as long as we continue to own profitable businesses with strong balance sheets that are undervalued I believe we’ll do fine.

Recent Updates

This quarter I was interviewed by Edwin Dorsey at his Sunday’s Idea Brunch. We talked about my background, investing philosophy, idea generation and a couple of my investment ideas. Feel free to give it a read. Any feedback is always welcome.

If you didn’t get around to read any of the blogs posted during the quarter I’ll attach them below. Don’t forget you can subscribe on the website to both the blog and future letters if you wish.

Sincerely,

Anthony

|

It’s always welcoming to investors when you read in the annual report that the company’s approach to corporate governance is ”we manage our business with the aim of returning profits to shareholders”. SE Holdings and Incubations Co., Ltd (9478.T) is a holding company that has 5 subsidiaries with the largest subsidiary being a niche publisher of IT and other technical books and manuals that did ¥4.4 billion (61%) of overall revenue and ¥344 million (65%) of overall net income last year. They publish these in book format to distributors and retailers or as e-books online. From what I can see they’ve been profitable going back to 2008. They are one of many companies in Japan that are trading at a negative enterprise value:

This leaves an EV of negative ¥2.2 billion. It also trades at 56% of book value and 68% of NCAV. But when they say their aim is to return profits to shareholders, they really mean it. Over the past 6 years, they’ve been a serial acquirer of their own shares, going from 23.5 million shares outstanding to 14.6 million (subtracting treasury shares and repurchases in July and August). So they’re a profitable net-net that has repurchased 38% of their shares in the last 6 years. The CEO owns 17% of the company and some other insiders own another 10% creating strong alignment with shareholders here. They are projected to do ¥900 million in EBIT and ¥600 million in net income this upcoming year but putting any type of multiple on their business is useless until they trade up to at least book value in my opinion. A similar sized niche publisher in Japan, Impress Holdings (9479.T), that lost money on an operational basis the past 2 years just went private at a P/B of 0.78x. But this reminds me of Sankyo (6417.T), a pachinko manufacturer who was trading under book value in 2020 and has since gone on to repurchase nearly half of their shares outstanding and rerated currently to over 2.3x book value with the stock compounding at 42%/year. Fair value to me for SE Holdings is a minimum of at least book value for a profitable, serial share acquirer which would imply a doubling of the stock price. With great capital allocation this stock should clearly trade for over book value but the more stock they buy back under book the more accretive it is for remaining shareholders. I’m hoping this replicates the Sankyo outcome. This is our largest Japan holding currently. I’m very familiar with Canadian estate tax but I never thought I would need to study Japanese estate taxes. Japan has an inheritance tax that is the reverse of many countries. Usually the estate has to pay taxes due to the death of the individual prior to distributing the assets but in Japan it’s the individual beneficiaries of the estate, aka the heirs, that have to pay it. The taxes are based on the fair market value of the assets at death and real estate is used at 70% of fair market value typically. Once the individual passes, the heirs tax return is due 10 months from that date. This can create all kinds of problems as you can inherit an extremely valuable asset but now have no means of paying the tax owing on that inheritance. There are some deductions and exemptions for the heirs that would lessen the tax blow but if dealing with assets in the billions of yen, it won’t help that much. If the only heir is your spouse they can rollover all the assets tax free but if you have children they need to pay their share of the statutory inheritance tax. A couple of options available when dealing with this problem is to have the company buy back the shares from the heirs so they can pay the tax bill (See Nintendo in 2013) or in the event of a company that has large real estate holdings, they can take on large amounts of debt that can be deducted from the overall fair market value of the property thereby decreasing the total tax bill. Why do I bring this all up? Because TOC Co., Ltd. (8841)’s Chairman, Kazuhiko Otani, passed away on Jan. 7, 2025. He’s part of the founding family who owns just over 50% of TOC. TOC is a real estate company that owns 12 commercial properties in the Tokyo area with one of them being the iconic TOC building that leases to retail/office and hosts events and is in the process of releasing the property because of a redevelopment that was pushed back to the early 2030’s. With a market cap of ¥72 billion, it holds ¥53 billion in cash and securities and debt of ¥8.3 billion giving it an enterprise value of ¥28 billion. Their total liabilities are only ¥13.6 billion. While their operating income last year of ¥1.4 billion doesn’t make it seem like that great of a bargain, this number was suppressed because they removed all their tenants in anticipation of redeveloping the main building but chose to forgo it and are now bringing their tenants back in. What makes this compelling is that in their notes to the financials they have marked their real estate to fair value and this year they valued it at ¥184 billion. Based on my analysis, TOC trades at 40% of NAV and they bought 6% of their shares back this year too. From what I can see, the former chairman personally owned 2% of the company but there are other Otani family companies that own shares in TOC and vice versa meaning his stake is likely higher than this. So his heirs taxes are currently “on the clock” for early November. One way of significantly reducing the taxes would be to take on a lot of debt via either an MBO or a dividend recap. In Japan, it can be tough to find family lineage as it’s usually not disclosed but I believe he had a wife and daughter and if there are more heirs they need to deal with their taxes soon. If for some reason they are able to defer it or there are no other heirs but the wife, we still own an extremely undervalued real estate company with potential earnings inflecting that just bought back some shares. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here